vitapant.ru Community

Community

Best Way To Get Rid Of Clover Mites

CONTROL MEASURES · Grass and shrubbery growing against foundation walls make it easy for mites to get from lawn to house. · Spray both barrier strip and. This treatment will not provide any residual control. A spray of Dursban There is no way to anticipate movement of the mites in the spring or fall. Using a wet sponge or a crevice attachment of a vacuum cleaner to remove mites, making sure to take precautions to avoid crushing the mites and causing stains. The best way to get rid of clover mites from your home is to contact a pest How do I make my property less attractive to clover mites? There are. How can I prevent a clover mite problem? · Create a grass-free zone around the perimeter of your house · Clear away plants and flowers that attract clover mites. The traditional control for clover mites is to apply an insecticide spray as a chemical barrier around the house. Description of clover mites. Clover mites are. To kill a group of mites, spray them with an indoor-safe insecticide like permethrin, diazinon, bifenthrin, or chlorpyrifos. On the inside, use a vacuum cleaner with proper attachments to effectively collect live mites without crushing them. Dispose of the sweeper bag after. Do not worry if Clover mites have already made their way into your home; instead, treat the area with Pyrid Aerosol. A single spray of this fast-acting spray is. CONTROL MEASURES · Grass and shrubbery growing against foundation walls make it easy for mites to get from lawn to house. · Spray both barrier strip and. This treatment will not provide any residual control. A spray of Dursban There is no way to anticipate movement of the mites in the spring or fall. Using a wet sponge or a crevice attachment of a vacuum cleaner to remove mites, making sure to take precautions to avoid crushing the mites and causing stains. The best way to get rid of clover mites from your home is to contact a pest How do I make my property less attractive to clover mites? There are. How can I prevent a clover mite problem? · Create a grass-free zone around the perimeter of your house · Clear away plants and flowers that attract clover mites. The traditional control for clover mites is to apply an insecticide spray as a chemical barrier around the house. Description of clover mites. Clover mites are. To kill a group of mites, spray them with an indoor-safe insecticide like permethrin, diazinon, bifenthrin, or chlorpyrifos. On the inside, use a vacuum cleaner with proper attachments to effectively collect live mites without crushing them. Dispose of the sweeper bag after. Do not worry if Clover mites have already made their way into your home; instead, treat the area with Pyrid Aerosol. A single spray of this fast-acting spray is.

The best way to get rid of clover mites from your home is to contact a pest How do I make my property less attractive to clover mites? There are. When smashed, adult clover mites leave behind a red stain, especially on items such as curtains, wallpaper, rugs, and other furniture that are lighter in color. If it's too late and a clover mite infestation has already taken place, an effective way to get rid of them is by vacuuming. However, when you attempt to remove. Use a soap solution – Mix a few drops of dish soap with water and spray the solution onto areas where the mites are present. · Use diatomaceous earth – This is a. Select an insecticide for outdoor use that is specifically labeled to control mites. There are different products available that vary in the number of days the. Once a clover mite infestation becomes established inside the home, the best method of removal is to vacuum up the pests while taking care not to crush them to. 10 Best Way To Get Rid of Clover Mites Naturally: · 2. Seal the Fortress: · 3. Harness the Power of Water: · 4. Embrace Natural Predators: · 5. Opt. If you find clover mites inside, you should only remove them using a vacuum cleaner with a hose attachment. Don't attempt to crush or wipe them away, or they'll. Overgrown vegetation creates a perfect environment for a clover mite infestation and may offer easier entry into the home. How Can I Get Rid of Clover Mites? If. Hi, Thanks for the ask to answer! To discourage and get rid of clover mites: Know where to find them! Look underneath the bark and the base. To get rid of clover mites, start by sealing entry points into your home, including gaps around windows, doors, and utility lines. Vacuum up mites indoors and. For longer lasting residual and a more cost effective approach, get BITHOR. Mixing it oz to a gallon of water, Bithor can be sprayed on carpeting. Large number of clover mites · Treat the foundation with a residual pesticide such as permethrin, bifenthrin or cyfluthrin. · Contact a professional pest control. These mites are difficult to control with chemicals that are safe to use inside homes. Again, a pest control professional is a good choice since they are. Insecticides containing carbaryl or acephate will kill clover mites on contact; reapply as necessary until the infestation has been eliminated. If you want to. Once a clover mite infestation becomes established inside the home, the best method of removal is to vacuum up the pests while taking care not to crush them to. How to Get Rid of Clover Mites · 1. Keep grass and weeds away from the foundation of your house, leaving a strip of about two feet wide. · 2. If you have mulch. The best way to prevent entry is to remove grasses and weeds in a three-foot for clover mite control tend to be short-lived. Treat when daytime tem. They can stain wood or painted surfaces, so using a vacuum to remove a population is the best method for removal. We recommend our Healthy Home Maintenance Plan.

Best Solo 401k Providers

The best (k) providers August · ADP · Charles Schwab · ShareBuilder k · Fidelity Investments · T. Rowe Price · Merrill Edge · Employee Fiduciary · Vanguard. Fidelity and Vanguard are among the largest fund companies in the world, and both offer (k) plans as parts of their services.1 Since (k) plans operate. What are the benefits of an Individual (k) plan? Every Schwab account comes with one-on-one investment help and guidance. With this account, you'll also get. The best (k) plans will provide you with full ERISA creditor protection for the same cost as a Solo(k). [Author's note: I happen to think our plans are. The Ascensus Individual(k) plan featuring Vanguard investments is a great option for small business owners looking for an owner-only plan. For those looking to get the most out of their retirement savings, the Solo (k) is the best option currently available. Those who qualify for the Solo (k). The solo (k) companies to consider · Best for mutual funds: Fidelity · Best for low expense ratios: Vanguard · Best for alternative investments: Rocket Dollar. IRAR's Solo k Retirement Plan is % Self-Directed · Experience the Highest Level of Compliance and Efficiency · Don't Let Anything Fall Through the Cracks! Self-employed individuals and owner-only businesses and partnerships can save more for retirement through a (k) plan designed especially for them. The best (k) providers August · ADP · Charles Schwab · ShareBuilder k · Fidelity Investments · T. Rowe Price · Merrill Edge · Employee Fiduciary · Vanguard. Fidelity and Vanguard are among the largest fund companies in the world, and both offer (k) plans as parts of their services.1 Since (k) plans operate. What are the benefits of an Individual (k) plan? Every Schwab account comes with one-on-one investment help and guidance. With this account, you'll also get. The best (k) plans will provide you with full ERISA creditor protection for the same cost as a Solo(k). [Author's note: I happen to think our plans are. The Ascensus Individual(k) plan featuring Vanguard investments is a great option for small business owners looking for an owner-only plan. For those looking to get the most out of their retirement savings, the Solo (k) is the best option currently available. Those who qualify for the Solo (k). The solo (k) companies to consider · Best for mutual funds: Fidelity · Best for low expense ratios: Vanguard · Best for alternative investments: Rocket Dollar. IRAR's Solo k Retirement Plan is % Self-Directed · Experience the Highest Level of Compliance and Efficiency · Don't Let Anything Fall Through the Cracks! Self-employed individuals and owner-only businesses and partnerships can save more for retirement through a (k) plan designed especially for them.

(k) Providers ; GO · · 28 ; Fidelity Investments · · 69, ; Vanguard · · 22, ; T. Rowe Price · · 7, ; Charles Schwab · · 26, Broad Financial's Checkbook Solo (k) lets you maximize your retirement contributions and place those funds in a variety of retirement assets. And that's just. If you're looking to keep or establish a Roth Solo k plan with participant loan capabilities, look no further. Plus get access a world of alternative. What Account Type is Best? Please use the table and resources below to providers and does not sell investments or provide investment, legal, or tax. IRS Excel List of k Plan Document Providers · Determining Pre-approved k plans · American IRA · Pensco Trust · Provident Trust · Equity Trust · IRA Services. Benefit Providers. Let's work together to reach those that need our The self-employed sometimes believe they are left out of the best retirement. Mountain West IRA consists of self-directed solo k providers for the Individual (k) Retirement Plan Explore videos to help you choose the best. Vanguard has transferred existing Individual (k), SIMPLE IRA, and SEP-IRA plans with multiple participants to Ascensus. If you're just getting started, those. With Safeguard Advisors Solo (k), you control the plan & can directly make plan investments in a diversified fashion. Our goal is your investing success. Paying too much for your Solo (k)? Our article unlocks 5 factors to a smooth, secure, and affordable retirement journey. E*TRADE tops our list for best solo (k) providers due to its wealth of investment choices and competitive pricing. Investors who choose E*TRADE won't owe any. Our Solo (k) plans provide a great alternative opportunity for self-employed individuals and small business owners who don't have common law employees. Main Individual k Providers · Vanguard (Allows Roth contributions but no rollovers or k loans. · Fidelity (No Roth. · TD Ameritrade (Irrelevant, will be. We've reviewed many solo (k) providers and compare the best below, including their costs and fund options. Companies like ShareBuilder k are experienced. Retire with a self-directed or solo (k) from Accuplan. Ideal for self-employed and small businesses. Diverse investment options. Start Now. A Self-Employed (k), also called a solo (k), is a version of the If you decide that a self-employed (k) is a good match for your situation. Traditional IRA · Roth IRA · Solo (k) · SEP IRA · SIMPLE IRA · Inherited IRA · Health Savings Account (HSA) · Education Savings Account (ESA). The Roth Solo 40(k) is the best retirement plan for self-employed and small business owners. With the potential increase of federal and state income tax rates. Compare Self-directed Solo k vs IRA LLC: What is the best option? My Ubiquity Solo k Review - How to Change Solo k Providers. My Solo k. Some of the banks that offer Solo (k) accounts include Chase Bank, Bank of America, and Wells Fargo. Self-directed custodians. These providers allow Solo

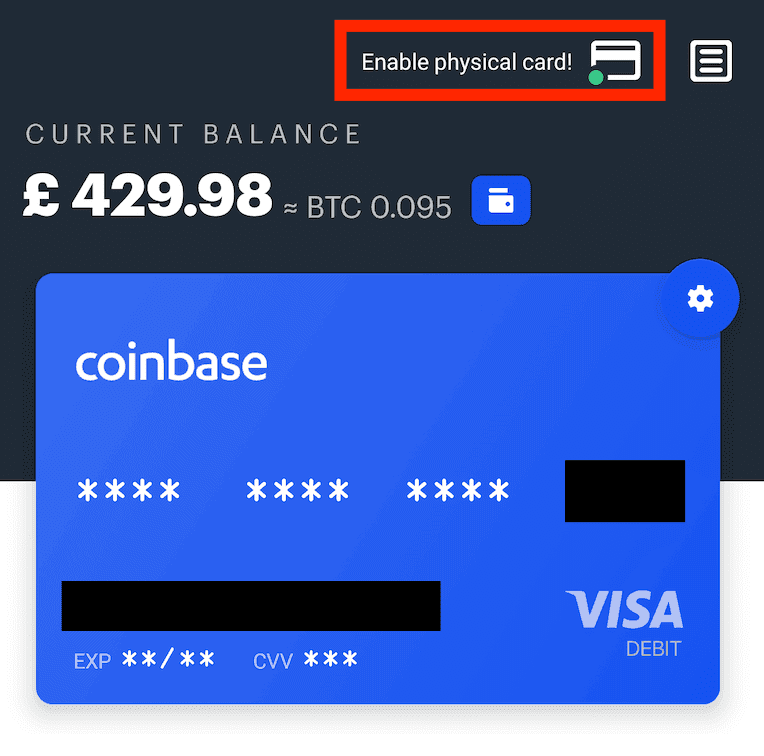

Coinbase Crypto Card Review

Coinbase is our top overall choice for a Bitcoin debit card. You can use it anywhere Visa is accepted, supports up to eight different cryptocurrencies, and. Coinbase uses industry-leading security and encryption to protect your assets, with auto-enrolled two-factor authentication. They also require multi-approval. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. On the other hand, Coinbase's Visa card gives users 4% cash-back on all spending and 1% cash-back when converting their crypto to fiat currency. So, which card. Answer: There are many crypto debit cards including vitapant.ru debit cards, Coinbase Card, Nexo, Crypterium, SoFi, Wirex, TenX, and Swipe Visa debit cards. Crypto Cards Review. Binance Card; Wirex Bitcoin Debit Card; vitapant.ru Visa Card; Coinbase Card; Eidoo Card; Monolith; Plutus Card · Crypto Cards Comparison. Compared to the other crypto cards out there, Coinbase Card is actually quite expensive. Sure, there are no monthly fees and the issuance fee is quite moderate. Coinbase offers users one of the most affordable cards for crypto spending. The card can be accessed for free in supported regions, like the UK, with no card. The US version of the Coinbase debit card comes with lower fees, higher rewards and more supported cryptocurrencies. Coinbase is our top overall choice for a Bitcoin debit card. You can use it anywhere Visa is accepted, supports up to eight different cryptocurrencies, and. Coinbase uses industry-leading security and encryption to protect your assets, with auto-enrolled two-factor authentication. They also require multi-approval. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. On the other hand, Coinbase's Visa card gives users 4% cash-back on all spending and 1% cash-back when converting their crypto to fiat currency. So, which card. Answer: There are many crypto debit cards including vitapant.ru debit cards, Coinbase Card, Nexo, Crypterium, SoFi, Wirex, TenX, and Swipe Visa debit cards. Crypto Cards Review. Binance Card; Wirex Bitcoin Debit Card; vitapant.ru Visa Card; Coinbase Card; Eidoo Card; Monolith; Plutus Card · Crypto Cards Comparison. Compared to the other crypto cards out there, Coinbase Card is actually quite expensive. Sure, there are no monthly fees and the issuance fee is quite moderate. Coinbase offers users one of the most affordable cards for crypto spending. The card can be accessed for free in supported regions, like the UK, with no card. The US version of the Coinbase debit card comes with lower fees, higher rewards and more supported cryptocurrencies.

Coinbase Card is your gateway to spending crypto effortlessly. With global acceptance, robust security, and easy management via the app, it transforms your. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. I find that Coinbase Wallet is the best crypto wallet out, from the ease of use to the large currency support it has, there is no better platform to use. Coinbase has the best cryptocurrency wallet which is also an exchange platform. The exchange platform has the option of buying Bitcoin, Ethereum and Litecoin. Coinbase Card allows residents to spend crypto (including USDC) and local currency wherever Visa cards are accepted. It can be used for both cash and. I find that Coinbase Wallet is the best crypto wallet out, from the ease of use to the large currency support it has, there is no better platform to use. About Coinbase. Information provided by various external sources. Coinbase is the easiest and most trusted place to buy and sell cryptocurrency. Contact. Coinbase Crypto Card Coinbase crypto card is a Visa debit card, funded by your Coinbase balance. You can use it in millions of locations around the world for. The Coinbase card provides users with cashback that range from 1% to 4%, depending on the crypto assets they want to earn rewards in. You can choose from such. The Coinbase Visa card is a relatively simple card compared to some of its competitors. It offers up the ability to spend your cryptocurrencies and earn. Coinbase is the more simplified platform but supports fewer crypto assets and has higher fees. Coinbase Advanced has more trading options but will likely be. The easiest, quickest way to spend your crypto worldwide. A Visa debit card that makes crypto as spendable as the money in your bank, powered by your Coinbase. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. If you choose to link your debit card for example, Coinbase will save the credit card number saving you time on the next instance where you buy crypto on. The Coinbase card doesn't charge transaction fees but you need to pay a relatively high % conversion fee when you make purchases with any crypto apart from. Coinbase is the most popular crypto exchange worldwide. It's the 'go-to' place for beginners and advanced traders alike, thanks to it being easy to use, and. Coinbase is the most popular crypto exchange worldwide. It's the 'go-to' place for beginners and advanced traders alike, thanks to it being easy to use, and. There are also potential tax implications for converting crypto assets into fiat currency. The Coinbase Card is compelling when maintaining a USDC balance. You'. Meanwhile, you can use your card number listed in your Coinbase account for online purchases. Use your card at Visa merchants, excluding specific categories.

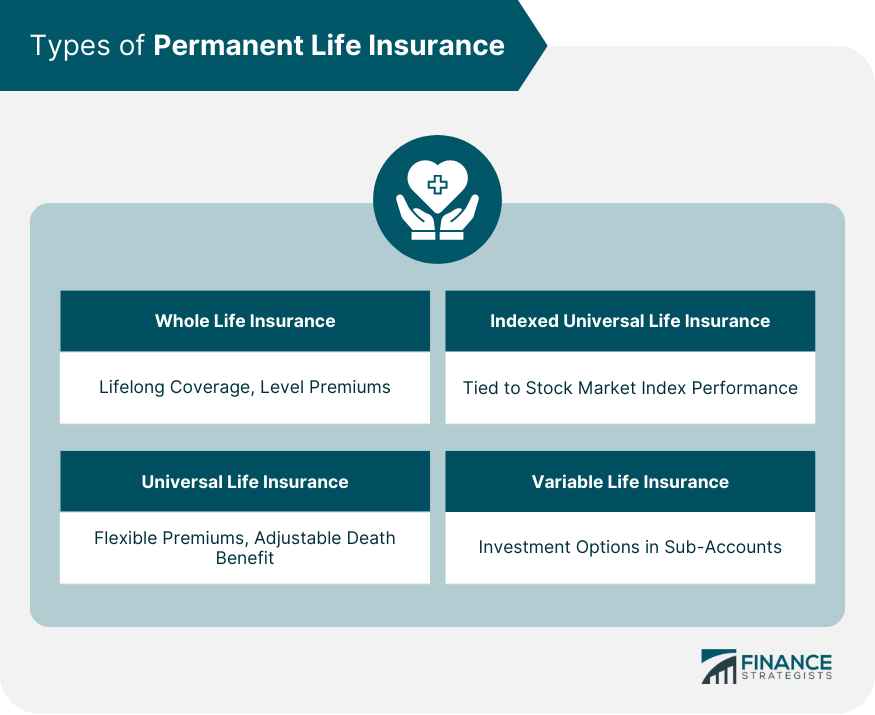

Permanent Life Insurance Policy Definition

Term life policies pay a lump sum, called a death benefit, to your beneficiaries if you die during the policy's term. The policy ends at the end of the term. Whole life insurance is a comprehensive and enduring form of life insurance that provides long-term coverage and financial security throughout an. Permanent life insurance: As the name suggests, permanent life policies (such as whole life) are designed to provide long-term—often lifelong—coverage. As. Because a limited pay life policy is a special type of permanent life insurance, your coverage lasts for the duration of your entire life, just like a whole. Guaranteed Insurability Option · Guideline Premium Test (GPT) · Level-Premium Term · Life Insurance Retirement Plan (LIRP) · Modified Endowment Contract (MEC). Because a limited pay life policy is a special type of permanent life insurance, your coverage lasts for the duration of your entire life, just like a whole. Permanent insurance provides long-term financial protection. These policies include both a death benefit and, in some cases, cash savings. Because of the. Term life insurance guarantees payment of a stated death benefit to the insured's beneficiaries if the insured person dies during the specified term. · These. Permanent life insurance policies offer a death benefit and cash value. The death benefit is money that's paid to your beneficiaries when you pass away. Term life policies pay a lump sum, called a death benefit, to your beneficiaries if you die during the policy's term. The policy ends at the end of the term. Whole life insurance is a comprehensive and enduring form of life insurance that provides long-term coverage and financial security throughout an. Permanent life insurance: As the name suggests, permanent life policies (such as whole life) are designed to provide long-term—often lifelong—coverage. As. Because a limited pay life policy is a special type of permanent life insurance, your coverage lasts for the duration of your entire life, just like a whole. Guaranteed Insurability Option · Guideline Premium Test (GPT) · Level-Premium Term · Life Insurance Retirement Plan (LIRP) · Modified Endowment Contract (MEC). Because a limited pay life policy is a special type of permanent life insurance, your coverage lasts for the duration of your entire life, just like a whole. Permanent insurance provides long-term financial protection. These policies include both a death benefit and, in some cases, cash savings. Because of the. Term life insurance guarantees payment of a stated death benefit to the insured's beneficiaries if the insured person dies during the specified term. · These. Permanent life insurance policies offer a death benefit and cash value. The death benefit is money that's paid to your beneficiaries when you pass away.

A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. Much like universal life insurance. If you die while your policy is still active, then your beneficiary receives the death benefit payout. Since it lasts for a set period of time, term life is. Permanent insurance is as it sounds — coverage that remains in place until you die. In addition, permanent life insurance can be a financial tool that can help. Universal life insurance is protection under which a policyholder may pay premiums at any time, in virtually any amount, subject to certain minimums. The. Permanent life insurance policies remain active until you die, unless you stop paying your premiums or surrender the policy. The 3 most common types of. Using a universal life policy basic illustration as an example, the non-guaranteed elements include current death benefits, current fund accumulation, and. Whole life insurance provides lifelong coverage at a fixed price for the policy's payment period. Learn about whole life insurance policies and request a. What are the different types of permanent life insurance policies? · Whole or ordinary life · Universal or adjustable life · Variable life · Variable-universal life. Term insurance provides protection for a specified period of time. This period could be as short as one year or provide coverage for a specific number of years. Term life insurance is a type of life insurance policy that has a specified end date, like 20 years from the start date. The death benefit will only be paid out. With whole life insurance, unlike term, you build guaranteed cash value. Cash Value Money that grows in your policy that you can access while you're still alive. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. The premium depends on your age. Whole life insurance (also referred to as permanent life insurance) refers to life insurance policies that are meant to last until death and have an. Whole life insurance, or whole of life assurance sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. The premium depends on your age. Whole life insurance is a type of permanent life insurance, which means the insured person is covered for the duration of their life as long as premiums are. Universal Life Insurance -- A flexible premium life insurance policy under which the policyholder may change the death benefit from time to time (with.

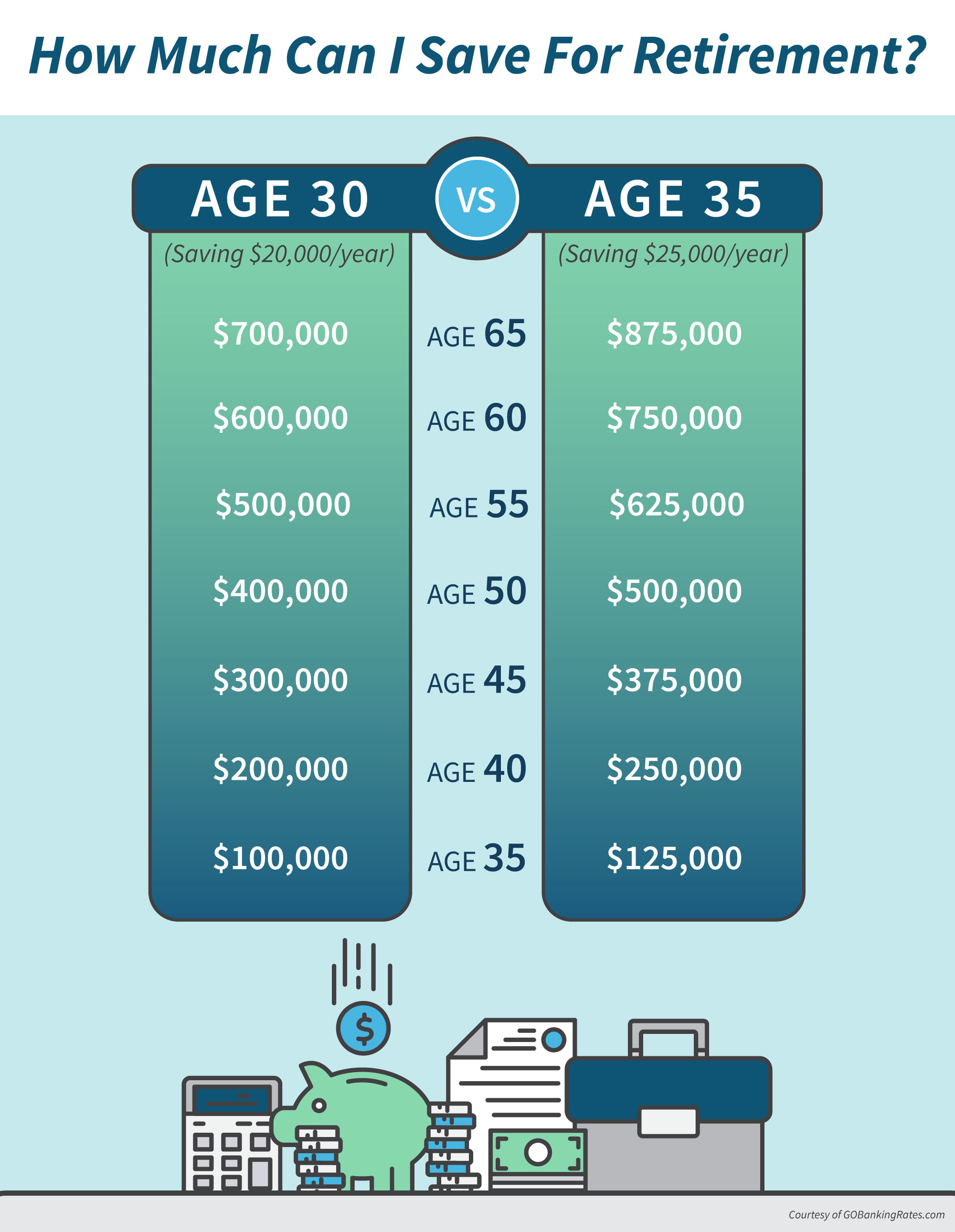

Amount To Save For Retirement

the amount you save each month. The sooner you start saving, the more time your money has to grow (see the chart below). Make saving for retirement a priority. You can calculate it by multiplying the number of years you anticipate living in retirement by the amount you expect to spend each year. Monthly investment: The. Someone between the ages of 36 and 40 should have times their current salary saved for retirement. Someone between the ages of 41 and 45 should have To retire by 40, aim to have saved around 50% of your income since starting work. cost of administering investment programs, we are able to keep the fees low. Knowing the true cost of your investments is a critical part of retirement savings. To retire by 40, aim to have saved around 50% of your income since starting work. All savings are for retirement. Savings are pretax, equivalent to 15% of gross income, and adjusted assuming an inflation rate of 3% per year. We assume an. Amount Invested. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. the amount you save each month. The sooner you start saving, the more time your money has to grow (see the chart below). Make saving for retirement a priority. You can calculate it by multiplying the number of years you anticipate living in retirement by the amount you expect to spend each year. Monthly investment: The. Someone between the ages of 36 and 40 should have times their current salary saved for retirement. Someone between the ages of 41 and 45 should have To retire by 40, aim to have saved around 50% of your income since starting work. cost of administering investment programs, we are able to keep the fees low. Knowing the true cost of your investments is a critical part of retirement savings. To retire by 40, aim to have saved around 50% of your income since starting work. All savings are for retirement. Savings are pretax, equivalent to 15% of gross income, and adjusted assuming an inflation rate of 3% per year. We assume an. Amount Invested. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will.

You can calculate it by multiplying the number of years you anticipate living in retirement by the amount you expect to spend each year. Monthly investment: The. The mean amount of retirement wealth for all families in was $, Aim to save 15% of your salary for your retirement. If that's not feasible. Why it's important to save for retirement as soon as you can ; Start saving at age: 25, 35 ; Saving for: 10 years, 30 years ; Yearly contributions: $3,, $3, At your age, if you save just percent of your annual income from now until you reach retirement age, you should be in pretty good. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. Americans in their 40s have an average retirement savings balance of $,; the median is $, As you age, your salary may increase, and you might be. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. 1. Aim to save between 10% and 15% of your annual pretax income for retirement · 2. Determine how much retirement income you may receive from sources other than. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. But one big thing that you can control is the amount you save. Find out why saving for retirement is so critical. When's the best time to start saving for. How Much Should I Save for Retirement Each Year? One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. How much should I save/ have saved for retirement? The good people at The Money Guy recommend saving a flat 25% of gross yearly income. The. Some experts claim that savings of 15 to 25 times of a person's current annual income are enough to last them throughout their retirement. Of course, there are. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly salary you earned while working. This. the amount you save each month. The sooner you start saving, the more time your money has to grow (see the chart below). Make saving for retirement a priority. Having a clear idea of the sort of lifestyle you want in retirement will help you estimate how much it could cost. Start by thinking about your essential or. In retirement planning, the most important number is not the total amount of money you have saved, but how that grand total will translate into a sustained. Many financial professionals recommend saving 10% to 15% of your total income. Yet how much you should save largely depends on your retirement goals, age, and. If you start saving in your 20s, contributing 10% to 15% of your paycheck (including any savings match from your employer), you'll likely meet your retirement.

Average Price For Interior House Painting

The cost of an interior painting project ranges between $ and $3,, with a national average of $2, At about $2 to $6 per square foot for both materials. For smaller exterior projects (for example, fascia boards or trim only), prices can range from $1,$5, + GST. For full exterior painting projects, our. About $ for (2) coats on ceilings and (2) coats on walls in (1) color, with no accent walls, for normal sized bedroom about 12× No. The cost of painting a house interior can vary based on several factors. On average, homeowners can expect to spend between $2, and $5, for a 3 bedroom. Painters charge $ to $1, per room on average, depending on the size. The average cost to paint a 12x12 room is $ to $ A professional painter will charge at least $30 per hour (up to $80). The rate will be between $15 and $25 per hour for a student painter. Cost to Paint a Home ; Totals - Cost To Paint Home, SF, $, $ ; Average Cost per Square Foot, $, $ Average Cost of Interior House Painting. First things first, let's talk numbers. The cost to paint the interior of your house can vary widely. On average. Average Painting Cost · $ -$19, to paint a 2, sq. ft. house, with an average of $11, · $$ to paint a sq. ft. room · $1,$3, to. The cost of an interior painting project ranges between $ and $3,, with a national average of $2, At about $2 to $6 per square foot for both materials. For smaller exterior projects (for example, fascia boards or trim only), prices can range from $1,$5, + GST. For full exterior painting projects, our. About $ for (2) coats on ceilings and (2) coats on walls in (1) color, with no accent walls, for normal sized bedroom about 12× No. The cost of painting a house interior can vary based on several factors. On average, homeowners can expect to spend between $2, and $5, for a 3 bedroom. Painters charge $ to $1, per room on average, depending on the size. The average cost to paint a 12x12 room is $ to $ A professional painter will charge at least $30 per hour (up to $80). The rate will be between $15 and $25 per hour for a student painter. Cost to Paint a Home ; Totals - Cost To Paint Home, SF, $, $ ; Average Cost per Square Foot, $, $ Average Cost of Interior House Painting. First things first, let's talk numbers. The cost to paint the interior of your house can vary widely. On average. Average Painting Cost · $ -$19, to paint a 2, sq. ft. house, with an average of $11, · $$ to paint a sq. ft. room · $1,$3, to.

So, a to square foot house in Connecticut can cost anywhere between $ and $ depending on the color and paint used. In fact, if you are planning. To complete any interior or exterior paint job it may cost you an average of $2, and $2, respectively. Textured and Popcorn Ceilings. Textured and popcorn. As per HomeGuide, the average cost to paint a house (interior) in Canada ranges between $ per square foot, putting the cost of painting a sq ft home. The average cost to paint the inside of a square foot home ranges from $3, to $4, This estimate can vary based on the quality of paint, the. Therefore, the average cost to paint the house's interior is between $3, and $10,, including labor and material costs. Interior Painting Cost by the Floor. About $ for (2) coats on ceilings and (2) coats on walls in (1) color, with no accent walls, for normal sized bedroom about 12× No. The typical range for a full interior paint job is from $$ per sqft. Much like the exterior of your home, as you move furniture out of the way, you. Professional painters charge anywhere between $5, and $45, to complete such a project, with the average cost typically falling within the range of $8, The price for painting a medium-sized house (– square feet) could start anywhere between $3, and $4, Meanwhile, a large house (– square. Interior painting will typically have a cost ranging anywhere from $2 to $6 per square foot of painting job. It will depend on the professional painter. On average, professional painters charge between $ and $ per square foot of a home's floor space to prime, paint, and seal walls. Interior House Painting Pricing Guide ; Powder Room 5' x 5' · $ Ceiling, $ Baseboards ; Bathroom 5' x 8' · $ Ceiling, $ Baseboards ; Standard Bedroom. Mid grade paint costs about $45 per gallon with contractor pricing. If you are painting your home for real estate purposes and you don't want to spend a lot of. On average, interior painting costs range from $ to $ per square foot, depending on the factors mentioned above. The average house painting cost per room in Vancouver is per room for the walls. This price includes the cost of paint, primer, other materials used in the. The average 12x12 room will cost $ - $ to repaint walls only. Repainting an entire room, including the walls, ceilings, trim, and baseboards will cost. The average cost of painting a house interior is between $2 and $6 for every square foot. If your house interior measures 2, square feet, then you can expect. house and the variables mentioned above. That said, the average cost for interior home painting projects in Calgary that we are typically working on is. Once you have your square footage most painters charge anywhere from $ – $ per square foot to paint ceilings. $ per foot would be an easy 1 coat. The cost of painting a 2, square foot house typically falls in the range of $3, to $4, · On average, homeowners in the United States report spending.

Stocks That Pay Every Month

monthly-paying stocks, Closed-End Funds and ETFs. While dividends could be paid annually, semiannually, or monthly, most firms pay quarterly (every three months). Global X is not affiliated with these financial service firms, Global X does not pay To be eligible, a fund must have received a FundGrade rating every month. Dividend-paying stocks have a very predictable payout timeline, making them a welcome addition to any well-rounded investment portfolio. The investor pays a small fee called a "load" for the privilege of working with the manager or firm. Another kind of stock fund is the exchange-traded fund (ETF). Monthly investment as SIP(systematic investment plan) if you would like to invest in mutual funds. Minimum SIP amount is rs. /-. He contributes the extra $ to his portfolio and keeps reinvesting his dividends and interest payments. His investment still earns 8% per year. For. DX I beleive is monthly cents a share and annually 13%. SP has been down past year but up recently. Award Share. u/BURRITOBOMBER1 avatar · BURRITOBOMBER1. • 4mo ago. Does it pay a dividend every month? Or quarterly? Upvote 1. Downvote Reply. Some of the most popular examples of monthly dividend paying stocks are a real estate investment trust (REIT) such as Realty Income (NYSE:O) which bills itself. monthly-paying stocks, Closed-End Funds and ETFs. While dividends could be paid annually, semiannually, or monthly, most firms pay quarterly (every three months). Global X is not affiliated with these financial service firms, Global X does not pay To be eligible, a fund must have received a FundGrade rating every month. Dividend-paying stocks have a very predictable payout timeline, making them a welcome addition to any well-rounded investment portfolio. The investor pays a small fee called a "load" for the privilege of working with the manager or firm. Another kind of stock fund is the exchange-traded fund (ETF). Monthly investment as SIP(systematic investment plan) if you would like to invest in mutual funds. Minimum SIP amount is rs. /-. He contributes the extra $ to his portfolio and keeps reinvesting his dividends and interest payments. His investment still earns 8% per year. For. DX I beleive is monthly cents a share and annually 13%. SP has been down past year but up recently. Award Share. u/BURRITOBOMBER1 avatar · BURRITOBOMBER1. • 4mo ago. Does it pay a dividend every month? Or quarterly? Upvote 1. Downvote Reply. Some of the most popular examples of monthly dividend paying stocks are a real estate investment trust (REIT) such as Realty Income (NYSE:O) which bills itself.

36 dividend stocks 3 dividends a month. More like this. the best stocks for your divided portfolio growth, ariocats, high yield, etc. Let's talk about how to generate $10, per month in dividend income from Canadian stocks. They also distribute payments every month. Pembina Pipeline has an attractive dividend yield and pays cash dividends every month. This company generates income from transporting oil and natural gas. Your circumstances are assessed every month so the amount you're paid may change. stocks, bonds, GICs, etc.;; Details of items you own, such as property. Typically, stocks and funds pay dividends on a quarterly or semi-annual basis. every month, these firms can offer plenty of appeal for income seekers. WHAT OTHER RESOURCES DO NOT COUNT FOR SSI? · retroactive SSI or Social Security benefits for up to nine months after you receive them (including payments. By locking in a 4% annual return, you'll receive 1% per quarter in dividends. It will take 10 quarters, 30 months or years to complete a 10% return. You. Find all BSE: Top Dividend Yield Stocks, Top High Dividend Stocks, Top Dividend Paying Stocks. Held on the 2nd OR 3rd Sunday of every month, across top. Source: Schwab Center for Financial Research, S&P Dow Jones Indices, as of 8/16/ Sectors are ranked as positive (+), neutral (N) or negative (—) for each. List of monthly dividend stocks · Realty Income [O] · Prospect Capital Corp [PSEC] · Shaw Communications [SJR] · LTC Properties [LTC] · Itaú Unibanco [ITUB]. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. For example, Procter & Gamble, the consumer-products giant, has paid a dividend every year since Procter & Gamble's stock price has not risen every year. No matter what your stage of life, dividend-paying stocks can be a valuable way to supplement your income and improve portfolio growth potential. income, pay attention to these reliable dividend stocks. Even better, the company pays out dividends per month rather than per quarter like most companies. Tracks common stocks of U.S. companies that have paid above-average dividends for the previous 12 months, excluding REITs. paying stocks will trail returns. Pay & Benefits · Employment Cost Index · Employer Costs This was the largest month increase since moving up percent for the year ended March DX I beleive is monthly cents a share and annually 13%. SP has been down past year but up recently. For example, if you own shares and are paid out $ for every share, you may get $ every quarter – or $50 annually. To qualify for a dividend payout. This is a page that lists all of the monthly paying preferred stocks that are available. Many monthly paying preferred stocks are from the Gladstone.

Heloc Loan For Home Improvement

A home equity line of credit (HELOC) is a loan which allows you to draw from the existing equity of your home as cash to finance things like large home. More Lending Options · Personal Loan · Home Equity Line of Credit (HELOC) · Home Equity Loan. A home equity line of credit might be used to fund an ongoing home remodel that's done room by room over the course of several months or years, while a home. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. Using your home's equity is a great way to fund a renovation. Message American Bank in TX to learn about our home improvement and home equity loan rates. Most lenders require you to have at least % equity in your home to qualify for a HELOC loan. Shop Around for the Best Rates. Different lenders offer. If you're looking for a break on your taxes, interest paid on the loan for most HELOCs and home equity loans is tax deductible, but it's wise to consult a tax. Most lenders require you to have at least % equity in your home to qualify for a HELOC loan. Shop Around for the Best Rates. Different lenders offer. Home equity is the perfect place to turn to for funding a home remodeling or home improvement project. It makes sense to use your home's value to borrow money. A home equity line of credit (HELOC) is a loan which allows you to draw from the existing equity of your home as cash to finance things like large home. More Lending Options · Personal Loan · Home Equity Line of Credit (HELOC) · Home Equity Loan. A home equity line of credit might be used to fund an ongoing home remodel that's done room by room over the course of several months or years, while a home. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. Using your home's equity is a great way to fund a renovation. Message American Bank in TX to learn about our home improvement and home equity loan rates. Most lenders require you to have at least % equity in your home to qualify for a HELOC loan. Shop Around for the Best Rates. Different lenders offer. If you're looking for a break on your taxes, interest paid on the loan for most HELOCs and home equity loans is tax deductible, but it's wise to consult a tax. Most lenders require you to have at least % equity in your home to qualify for a HELOC loan. Shop Around for the Best Rates. Different lenders offer. Home equity is the perfect place to turn to for funding a home remodeling or home improvement project. It makes sense to use your home's value to borrow money.

A home equity loan lets you borrow against the equity in your home. Pros of home equity loans. Interest may be tax-deductible when used for home improvements. We offer low home equity rates, including Lines of Credit. Compare our Home Equity and Home Improvement loan rates and terms. Whenever you need a loan to consolidate your bills, make home improvements, buy a car, fund educational expenses, or pay for a variety of other large expenses. A home equity line of credit, or HELOC, is a great financial tool available for home improvements due to low-interest flexible borrowing. HELOC stands for Home Equity Line of Credit - in our case we were able to use the equity we have to occasionally transfer money up to "X" amount. You can use the funds from a Home Equity Loan, just like cash, for large home renovations such as kitchen remodels, bathroom upgrades, and adding in a new. Yes you can use the HELOC for home improvement. it's not the most common use among my clients (debt consolidation and investment is). A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. In life, you often face major home improvement. Low rates. Great service. That's Lending Uncomplicated. Whole-project funding, with no fees, no home equity requirements. The unsecured LightStream loan has. FHA Title I loan. The FHA Title I loan program helps low- to moderate-income homeowners with no equity finance repairs and improvements worth up to $25, on a. Home equity line of credit (HELOC). Pay for your home improvements by borrowing against the value of your home at a lower interest rate than other types of. This guide will cover home equity loans for remodeling —how they work, when to use them, and which one to choose. Low rates. Great service. That's Lending Uncomplicated. Whole-project funding, with no fees, no home equity requirements. The unsecured LightStream loan has. A Home Equity Line of Credit (HELOC) and a Home Improvement Loan are two great options for homeowners to consider as resources for completing home improvements. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. In life, you often face major home improvement. A Home Equity Line of Credit (HELOC) and a Home Improvement Loan are two great options for homeowners to consider as resources for completing home improvements. Hometown Bank offers home equity lines of credit and home improvement loans so you can borrow from your existing mortgage or take out a second one. A HELOC is a line of credit that uses your home's equity to help you pay for home improvement projects, your child's education or other expenses, like. With a home improvement loan from Wells Fargo, borrowers are able to complete their home renovation project with a fixed-interest rate personal loan. We offer. With a home improvement loan from Wells Fargo, borrowers are able to complete their home renovation project with a fixed-interest rate personal loan. We offer.

How To Make Money Swapping Crypto

Swapping crypto allows you to easily exchange one crypto asset for another. Using Ledger will give you the possibility to swap quickly and securely. To make money trading currencies, you must correctly guess that your chosen currency will rise or fall in value against another. You can go long, meaning. These are the three most widely used methods of exchanging cryptocurrencies: OTCs, centralized and decentralized exchanges. In general, crypto swaps are subject to taxation, but in the case of a crypto swap loss, there is simply no income (also referred to as a capital gain) for the. StealthEX is a non-custodial Instant Crypto Swap Service that supports over assets. You can use this platform without the need to create an account. What is a crypto token swap? Simply put, a crypto swap is a direct exchange of one token for another without using a fiat currency as an intermediate step. In. Crypto traders can swap cryptocurrencies for profit using two ways: Swapping, then hodling – You can obtain lesser-known coins at bargain. 3. Yield Farming & Lending – Deposit and Lend Crypto Coins to Earn Interest. The most passive way to make money on cryptocurrency is through yield farming or. What is peer-to-peer (P2P) crypto earning? P2P platforms allow direct interaction between users. You can earn by: Lending crypto: Loan your coins to others. Swapping crypto allows you to easily exchange one crypto asset for another. Using Ledger will give you the possibility to swap quickly and securely. To make money trading currencies, you must correctly guess that your chosen currency will rise or fall in value against another. You can go long, meaning. These are the three most widely used methods of exchanging cryptocurrencies: OTCs, centralized and decentralized exchanges. In general, crypto swaps are subject to taxation, but in the case of a crypto swap loss, there is simply no income (also referred to as a capital gain) for the. StealthEX is a non-custodial Instant Crypto Swap Service that supports over assets. You can use this platform without the need to create an account. What is a crypto token swap? Simply put, a crypto swap is a direct exchange of one token for another without using a fiat currency as an intermediate step. In. Crypto traders can swap cryptocurrencies for profit using two ways: Swapping, then hodling – You can obtain lesser-known coins at bargain. 3. Yield Farming & Lending – Deposit and Lend Crypto Coins to Earn Interest. The most passive way to make money on cryptocurrency is through yield farming or. What is peer-to-peer (P2P) crypto earning? P2P platforms allow direct interaction between users. You can earn by: Lending crypto: Loan your coins to others.

Swapping is a process to exchange one cryptocurrency without having to convert it to fiat currency first. You can do this through a decentralized exchange. Enter the amount of your starting cryptocurrency and select a trading pair from a wide variety of combinations. Then, enter the destination address, which can. The need of the hour is easy and intuitive swaps from one major blockchain to another. money on the Ethereum network (ETH). Your best bet would be to. So, if you're looking to avoid paying more for your exchange, you can use aggregation services like Swapzone. When you create an order, we compare the deals. Crypto Swap enable the traders to swap one cryptocurrency for another, between two wallets, without the use of fiat cash as an intermediary. Bitcoin Cash & Litecoin. THORChain is Savers Vaults allow anyone to provide liquidity to THORChain and earn from swap fees without exposure to RUNE. IN THIS SPACE YOU FIND ARTICLES ABOUT HOW TO EARN MONEY ONLINE WITH GOOGLE. Follow. Profile photo for Abhishek Maurya. Swapping crypto enables you to exchange one cryptocurrency or digital asset for another. With the vitapant.ru Wallet app you can easily swap into a majority. Crypto swapping is the process of conveniently exchanging crypto assets for their equivalent value in another coin or token. Easy to follow trading processes that enable you to trade safely with escrow protection so you can convert Bitcoin to cash or trade cryptocurrency with hundreds. We provide a space for you to earn and generate your wealth enormously with our help through swapping, trading, farming and liquidity pools with SilverLineSwap. How to Make Money Swapping Crypto Did you know that you can also swap crypto for profit? You can swap your asset for a much cheaper token and then hold that. A cryptocurrency swap refers to exchanging one digital token for another. The whole process is similar to that of traditional currency exchange. If you are looking for a relatively secure way to invest your money and earn a steady return, peer-to-peer (P2P) lending is a great option. This is particularly. This is the most common way of earning money from cryptocurrencies. Most investors buy coins such as Bitcoin, Litecoin, Ethereum, Ripple, and more and wait. Making money by swapping BTC to Naira, the official currency of Nigeria has become a popular way to earn profits in recent years. As the value of Bitcoin. You can use Coinbase Wallet's 'Trade' feature to conduct decentralized token swaps on the Ethereum network, as well as Polygon, BNB Chain, and Avalanche. Wallets sometimes venture into launching their own tokens or coins, serving multiple purposes. Crypto wallets can make money from the launch of a new coin or. Crypto swapping is directly and conveniently exchanging crypto assets for their equivalent value in another coin or token without needing a. SimpleSwap is a cryptocurrency exchange that allows to swap BTC and altcoins in an easy way. SimpleSwap supports cryptocurrencies.

Navi Loan Reviews

ReviewsAboutApplyLoansCalculatorContact. Connect with me. Navi Marie JacksonLoan Officer | NMLS Whether it's your first home or your forever home, we. Navi's Reviews. We survey everyone who has submitted a loan application with this lender, whether the loan closed or not. Customer did not leave review comments. Overall, the app is very good and makes it easy to get and repay loans. However, the technical team should update the app to include a prompt before the loan is. Navi was fantastic throughout the loan process. He was very approachable and helpful. Will definitely recommend him. June Share Review. Facebook Linkedin. Navi Finserv's financial review. Employees. Total Funding. M. Last Navi is a Personal & Home Loan App where one can avail personal loans up to. Navi Finserv Pvt Ltd in Koramangala 5th Block,Bangalore listed under Home Loans in Bangalore. Rated based on Customer Reviews and Ratings with 3. What our customers say about us · It's a superb app that provides loan with minimum document. · The easiest way I have ever received a loan. · I required money for. Lightning fast UPI payments, instant Cash Loans & Home Loans, smart investments in Mutual Funds & Digital Gold, comprehensive Health Insurance - all in one. The Navi Loan App is safe as long as you are smart about who you loan money to and how much you loan them. ReviewsAboutApplyLoansCalculatorContact. Connect with me. Navi Marie JacksonLoan Officer | NMLS Whether it's your first home or your forever home, we. Navi's Reviews. We survey everyone who has submitted a loan application with this lender, whether the loan closed or not. Customer did not leave review comments. Overall, the app is very good and makes it easy to get and repay loans. However, the technical team should update the app to include a prompt before the loan is. Navi was fantastic throughout the loan process. He was very approachable and helpful. Will definitely recommend him. June Share Review. Facebook Linkedin. Navi Finserv's financial review. Employees. Total Funding. M. Last Navi is a Personal & Home Loan App where one can avail personal loans up to. Navi Finserv Pvt Ltd in Koramangala 5th Block,Bangalore listed under Home Loans in Bangalore. Rated based on Customer Reviews and Ratings with 3. What our customers say about us · It's a superb app that provides loan with minimum document. · The easiest way I have ever received a loan. · I required money for. Lightning fast UPI payments, instant Cash Loans & Home Loans, smart investments in Mutual Funds & Digital Gold, comprehensive Health Insurance - all in one. The Navi Loan App is safe as long as you are smart about who you loan money to and how much you loan them.

They are basically reading money transaction sms, giving you a profile and using this info for their Loan business. This is in NO way related to. KreditBee Upto 1 Lakh Instant Personal Loan Review | Aadhar Card Loan · Cash Bee Loan App Harassment | Cash Bee App Real Or Fake? · Bajaj Finserv 0% emi full. Navi Finserv Pvt Ltd has received ratings from users. And the average feedback from all of them suggests that Navi Finserv Pvt Ltd scores in the eyes of. reviews · Salary guide · Employers · Create your CV · Country and language navi loan jobs. 25+ jobs. Zone Head. Finqy. Surat, Gujarat. EmployerActive 3 days. Ratings and Reviews · I recently availed a home loan from Navi. To put in few words, I have had an amazing experience partnering with the team. · Delighted to. Employees in Bangalore have given Navi Finserv a rating of out of 5 stars, based on 15 company reviews on Glassdoor. Therefore, it is important to be smart and responsible when using the Navi Loan App. Thank you,. Hope you like it! product review. Top mentions in Navi Finserv Reviews. Senior Management (12). Salary (9). Job Home Loan. posted on 04 Jul Likes: Only Free Lunch & snacks. Navi Financial Services in Gajulpet,Nizamabad listed under Business Loans in Nizamabad. Rated based on 38 Customer Reviews and Ratings with 3 Photos. Navi, your all-in-one financial superapp designed for diverse financial needs, offers a range of services for your convenience. From lightning-fast UPI. Lightning fast UPI payments, instant Cash Loans & Home Loans, smart investments in Mutual Funds & Digital Gold, comprehensive Health Insurance - all in one. Navi is an Indian financial services company founded by Sachin Bansal and Ankit Agarwal in Navi operates in the space of digital Loans, home loans. If you need instant cash to cross any financial hurdle, choose Navi. It hardly takes a few minutes to apply and get the loan disbursed to your account if you. reviews · Salary guide · Employers · Create your CV · Country and language navi loan jobs. 25+ jobs. Zone Head. Finqy. Surat, Gujarat. EmployerActive 3 days. A home equity loan or line of credit can help you create the home of your dreams. Based on Reviews. Melissa Mack. Sep 6 Mickey Lawrence. Sep 5. Navi is a career banker with 32 years of financial and mortgage experience. As Vice President - Mortgage Production Manager, he oversees the production lending. for home loans. Review and verify all documentation related to Home Loans. Overall, how relevant are these jobs? Not at all. Slightly Somewhat. Details · Page · Financial service · vitapant.ru · 88% recommend (19 Reviews) · Pinned post. Navi is an Indian financial services company founded by Sachin Bansal and Ankit Agarwal in Navi operates in the space of digital Loans, home loans.

1 2 3 4 5 6 7