vitapant.ru Tools

Tools

Best Hotel Points Card

Best overall: IHG One Rewards Premier Credit Card. In the heated contest for best hotel rewards card, the IHG One Rewards Premier card comes out swinging. Membership Rewards points are hugely flexible, which is why we recommend this as the best choice for your first miles and points card. You can transfer them. IHG One Rewards Premier Credit Card: Best feature: Annual hotel night bonus. Capital One Venture X Rewards Credit Card: Best feature: 75,mile sign-up bonus. Cards affiliated with hotel brands offer points and rewards that you can earn and use when staying at hotels within that chain. The types of perks offered may. American Express has its own luxury hotel program, Fine Hotels & Resorts, where The Platinum Card® from American Express members receive a suite of benefits at. Other Cards with Solid Value for Hotel Perks (=) ; Citi Premier Card. Receive $ in hotel credit off a single stay of $ or more annually on booking made. This guide will help show you understand the variety of hotel cards out there, as well as help you select the best card for each of the major hotel groups. While the AmEx Hilton Aspire card is a hotel card first and foremost, its benefits put it on par with several general travel rewards cards. For that reason. Find the best hotel credit cards from Chase to earn points from travel and dining. Choose a hotel rewards credit card today and start earning points when. Best overall: IHG One Rewards Premier Credit Card. In the heated contest for best hotel rewards card, the IHG One Rewards Premier card comes out swinging. Membership Rewards points are hugely flexible, which is why we recommend this as the best choice for your first miles and points card. You can transfer them. IHG One Rewards Premier Credit Card: Best feature: Annual hotel night bonus. Capital One Venture X Rewards Credit Card: Best feature: 75,mile sign-up bonus. Cards affiliated with hotel brands offer points and rewards that you can earn and use when staying at hotels within that chain. The types of perks offered may. American Express has its own luxury hotel program, Fine Hotels & Resorts, where The Platinum Card® from American Express members receive a suite of benefits at. Other Cards with Solid Value for Hotel Perks (=) ; Citi Premier Card. Receive $ in hotel credit off a single stay of $ or more annually on booking made. This guide will help show you understand the variety of hotel cards out there, as well as help you select the best card for each of the major hotel groups. While the AmEx Hilton Aspire card is a hotel card first and foremost, its benefits put it on par with several general travel rewards cards. For that reason. Find the best hotel credit cards from Chase to earn points from travel and dining. Choose a hotel rewards credit card today and start earning points when.

You can redeem them for free travel, gift cards, products and more. They're your points. Reward yourself when, where and how you want! Explore Redemptions. Our best offer ever: Earn 5 Free Nights valued at up to , points (each IHG Careers Explore Hotels IHG Global Brands Hotel Development Travel. this is a great option. Personally, I think the IHG One Rewards Premier is a much better card for $99 and comes with a free night good up to 40k points. If. Best Hotel Credit Card Offers · Marriott Bonvoy Brilliant® American Express® Card · World of Hyatt Credit Card · Marriott Bonvoy Business® American Express® Card. Some TPG favorite cobranded hotel cards include: World of Hyatt Credit Card · Hilton Honors American Express Card · Hilton Honors American Express Surpass® Card. 5 Best Hotel Rewards Credit Cards – Reviews & Comparison · Best Overall: IHG One Rewards Premier Credit Card · Best for Grocery Spending: Hilton Honors American. Wyndham Rewards Named Best Hotel Loyalty Program for Fifth Consecutive Year by Readers of USA TODAY The accolades mark the fifth consecutive year Wyndham. Discover Marriott Bonvoy, The Hotel Loyalty Program That Rewards You at + Hotels Worldwide. Earn Free Nights, Discounted Member Rates & More With. Hotel rewards credit cards are among the best rewards deals. Hotel rewards card offers allow to earn points for booking a hotel room and for other purchases. [ ] that can be redeemed for cash. If you're looking for the Top 10+ Airline card bonuses or the Top 10+ Hotel card bonuses or the Best Rewards for Everyday. Best hotel credit cards of September Free nights and more ; Hilton Honors American Express Card · · Earn 80, points ; The Hilton Honors. Best hotel credit cards for September · Chase Sapphire Preferred® Card · Hilton Honors American Express Card · Capital One Venture X Rewards Credit Card · The. Here, we've compiled a list of the best credit cards for hotel points and airline miles based on this strategy. Earn 70, bonus ThankYou® Points after spending $4, in the first 3 months of account opening, redeemable for $ in gift cards or travel rewards at. Here, we've compiled a list of the best credit cards for hotel points and airline miles based on this strategy. Earn 70, bonus ThankYou® Points after spending $4, in the first 3 months of account opening, redeemable for $ in gift cards or travel rewards at. Hotel Loyalty Programs · Intercontinental · World of Hyatt · Marriott Bonvoy · Hilton Honors. The best hotel credit cards allow cardmembers to earn rewards points on eligible purchases. You can then use those points to boost your hotel loyalty account. Best overall: IHG One Rewards Premier Credit Card. In the heated contest for best hotel rewards card, the IHG One Rewards Premier card comes out swinging. Chase Sapphire Preferred® Card The Chase Sapphire Preferred Card is one of our favorite travel credit cards overall due to its high rewards rate and low.

What Is The Maximum Deduction For State And Local Taxes

Individual taxpayers who itemize their personal deductions can deduct up to $10, of their total state and local taxes per return annually ($5, for married. The amount of state and local income tax claimed on the Federal Schedule A, minus any earnings tax included in that amount. Other Deductions. Long-Term Care. Starting in tax year , taxpayers cannot deduct more than $10, of total state and local taxes. That provision of the law is scheduled to expire after Deductions: Taxpayers may reduce taxable compensation for allowable unreimbursed expenses that are ordinary, actual, reasonable, necessary and directly related. If you itemize your deductions and live in one of the 43 states with income taxes, you have the option of deducting either the state and local income taxes. Allows an income tax deduction for 20% of the sales tax paid on certain energy efficient equipment or appliances, up to $ per year. If filing a joint return. Taxpayers are limited to an annual deduction of $10, ($5, in the case of a married individual filing a separate return) of the following state and local. The cap is $5, for married taxpayers filing separately. Some states either have passed or are planning to pass new laws allowing taxpayers to make charitable. More In Credits & Deductions Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10, ($5. Individual taxpayers who itemize their personal deductions can deduct up to $10, of their total state and local taxes per return annually ($5, for married. The amount of state and local income tax claimed on the Federal Schedule A, minus any earnings tax included in that amount. Other Deductions. Long-Term Care. Starting in tax year , taxpayers cannot deduct more than $10, of total state and local taxes. That provision of the law is scheduled to expire after Deductions: Taxpayers may reduce taxable compensation for allowable unreimbursed expenses that are ordinary, actual, reasonable, necessary and directly related. If you itemize your deductions and live in one of the 43 states with income taxes, you have the option of deducting either the state and local income taxes. Allows an income tax deduction for 20% of the sales tax paid on certain energy efficient equipment or appliances, up to $ per year. If filing a joint return. Taxpayers are limited to an annual deduction of $10, ($5, in the case of a married individual filing a separate return) of the following state and local. The cap is $5, for married taxpayers filing separately. Some states either have passed or are planning to pass new laws allowing taxpayers to make charitable. More In Credits & Deductions Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10, ($5.

Today, the Tax Cuts and Jobs Act limits an individual's deduction to $10, ($5, if married filing separately) for the aggregate state and local taxes paid. The United States federal state and local tax (SALT) deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and. It represents the largest tax cut in the State's history. What Does the state and local taxes paid and the mortgage interest deduction. Taxpayers. The credit amount is limited to the lesser of the individual's state tax liability for that year of the maximum allowable credit of $5,, per owner, who. C.), would increase the current cap on the SALT deduction from $10, (and $5, in the case of a married individual filing a separate return) to $, . The Percentage Exclusion for capital gains is capped at $, This means that any gain above $, will be taxed at standard income tax rates. The Flat. As a result, Washington State residents may deduct state and local general-sales tax on their federal income returns for tax year and succeeding tax years. Limitation on deduction for state and local tax - Federal tax reform limited the amount you can deduct for state and local taxes. You cannot claim more than. As a result, Washington State residents may deduct state and local general-sales tax on their federal income returns for tax year and succeeding tax years. If you took state and local income tax as an itemized deduction on your federal return, enter that amount on line 14, up to $10, Do not include any sales. An individual may claim an itemized deduction on Schedule A (Form ) of up to only $10, ($5, if married filing separately) for. The deduction for state and local taxes is capped at $10, through , but other tax breaks and workarounds can help mitigate that. By Kimberly Lankford. The United States federal state and local tax (SALT) deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and. Important: For taxable years through , Code section limits the amount of the deduction for state and local tax (SALT) payments to $10, ($5, Your deduction for state and local income, sales, and property taxes is limited to a combined total deduction. The limit is $10, - $5, if married filing. Under the guidelines from the TCJA, however, the deduction for state and local income and property taxes is limited to one total combined deduction of $10, . If you took state and local income tax as an itemized deduction on your federal return, enter that amount on line 14, up to $10, Do not include any sales. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. Federal law limits your state and local tax (SALT) deduction to $10, if single or married filing jointly, and $5, if married filing separately. The SALT cap is set to expire after For now, it mainly affects high-income earners who live in high-tax states and itemize deductions. What is the SALT.

Celsius Network Review

There are not enough reviews of Celsius Network for G2 to provide buying insight. Below are some alternatives with more reviews: Wyre is a team of payment. CELSIUS NETWORK ICO REVIEW – P2P LENDING & BORROWING PLATFORM vitapant.ru #celsius #blockchain #cryptocurrency. Pros · No minimum deposit required. · Celsius doesn't require users to lock their crypto for a certain period of time. · Size: over $9 billion in user assets. The Celsius Network is a UK-based cryptocurrency and decentralised finance (DeFi) company that offers worldwide investing, borrowing and payment services. 63 people have already reviewed Celsius Network. Read about their experiences and share your own! We think vitapant.ruk is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). The. YouHodler pros · Clean UX/UI interface and user-friendly design for beginners and advanced users · Funds are never locked and features are never restricted. Positive: Instead of spending s of millions in marketing, Celsius returns their revenue to the community through higher deposit rates, which drives user. Celsius locked my money without consent. Celsius is demanding a video with audio to release funds. Celsius didn't request a video and audio before the deposit. There are not enough reviews of Celsius Network for G2 to provide buying insight. Below are some alternatives with more reviews: Wyre is a team of payment. CELSIUS NETWORK ICO REVIEW – P2P LENDING & BORROWING PLATFORM vitapant.ru #celsius #blockchain #cryptocurrency. Pros · No minimum deposit required. · Celsius doesn't require users to lock their crypto for a certain period of time. · Size: over $9 billion in user assets. The Celsius Network is a UK-based cryptocurrency and decentralised finance (DeFi) company that offers worldwide investing, borrowing and payment services. 63 people have already reviewed Celsius Network. Read about their experiences and share your own! We think vitapant.ruk is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). The. YouHodler pros · Clean UX/UI interface and user-friendly design for beginners and advanced users · Funds are never locked and features are never restricted. Positive: Instead of spending s of millions in marketing, Celsius returns their revenue to the community through higher deposit rates, which drives user. Celsius locked my money without consent. Celsius is demanding a video with audio to release funds. Celsius didn't request a video and audio before the deposit.

63 people have already reviewed Celsius Network. Read about their experiences and share your own!

Celsius Network LLC, et al. Case Number: (MG). Southern District Instead, please review the instructions set forth in Effective Date Notice. Celsius Network Review · Snapshot · What Is Celcius Network? · Sign Up Offer: Get $ in BTC from Celsius for Depositing Crypto for 30 Days. Celsius Network LLC is a Delaware limited liability corporation headquartered in Hoboken,. New Jersey. Celsius Network Limited is a United Kingdom corporation. people have already reviewed Celsius. Read about their experiences and share your own! Love Celsius. Multiple withdraws no issues at all. Most recent 50k Gusd withdraw only took 3 mins. Pros · No minimum deposit required. · Celsius doesn't require users to lock their crypto for a certain period of time. · Size: over $9 billion in user assets. Celsius Network Reviews · "Pretty bad, although can't say I am surprised" · "Most Transparent Crypto Yield Company" · "Celsius Has The Strongest Security Of All. Though Celsius Network is a legit business entity and has clear security measures to ensure the safety of the users' funds, please note that all cryptocurrency. There are currently no reviews for this Celsius Network. We believe that behind every review is an experience that matters and we value every feedback. In July , Celsius Network (Celsius), a cryptocurrency (crypto) network, filed for bankruptcy. Celsius was a "crypto bank" but often acted as a hedge. CEO Alex Mashinsky acknowledged that Celsius had grown its assets “faster than the Company was prepared to deploy [them]” and as a result had made “certain poor. r/CelsiusNetwork - One more month to go!!!! upvotes · 17 comments. More videos on YouTube The Celsius Network is a major decentralized finance application that offers Crypto savings and loans. The service is accessible via. Celsius Network makes money through lending. They lend out to institutions, but they also allow their users to take a loan in USD or stablecoins. Celsius Network, offers customers the ability to earn decent interest on bitcoin, gold and other cryptocurrency, get a cash loan using crypto as collateral. Celsius Network has an overall rating of out of 5, based on over reviews left anonymously by employees. 40% of employees would recommend working at. Reviews: Alex Mashinsky Interview - Celsius Network $M Funding Raise - US Crypto Regulations - BTC & ETH Price Predictions. Celsius Network,” according to a previously sealed indictment. These review if you like what you hear! Follow the money. Music NFT platform Sound. See what employees say it's like to work at Celsius Network. Salaries, reviews, and more - all posted by employees working at Celsius Network. Celsius Network makes money on crypto loans and distributes the profit among its „investors“ like you. They distribute 80% of its profit to their investors.

How Long Is Your Credit Ruined After Bankruptcy

If you filed for Chapter 13 bankruptcy, you could be eligible for a conventional mortgage as soon as two years after the Chapter 13 discharge, with even more. After a bankruptcy discharge, it can be easy to think that one's credit is ruined for good. However, the first few years after starting over can provide an. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. However, the truth is that by the time most people file bankruptcy, their credit rating is so low that the bankruptcy itself does little additional damage. In. While it can be challenging to look beyond the initial hit a credit score will take, bankruptcy is not designed to permanently ruin your credit. There are many. Your credit score will likely be impacted by the bankruptcy for the first two or three years immediately following your bankruptcy filing. After that time, it. In fact, both Chapter 7 and Chapter 13 bankruptcy stay on your credit report for about ten years. How Long Does Bankruptcy Remain on My Credit Report? The length of time that a bankruptcy filing remains on your credit report depends on the chapter you file. By fulfilling your bankruptcy obligations (making monthly payments and reports to your trustee, and attending credit counselling sessions), you will complete. If you filed for Chapter 13 bankruptcy, you could be eligible for a conventional mortgage as soon as two years after the Chapter 13 discharge, with even more. After a bankruptcy discharge, it can be easy to think that one's credit is ruined for good. However, the first few years after starting over can provide an. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. However, the truth is that by the time most people file bankruptcy, their credit rating is so low that the bankruptcy itself does little additional damage. In. While it can be challenging to look beyond the initial hit a credit score will take, bankruptcy is not designed to permanently ruin your credit. There are many. Your credit score will likely be impacted by the bankruptcy for the first two or three years immediately following your bankruptcy filing. After that time, it. In fact, both Chapter 7 and Chapter 13 bankruptcy stay on your credit report for about ten years. How Long Does Bankruptcy Remain on My Credit Report? The length of time that a bankruptcy filing remains on your credit report depends on the chapter you file. By fulfilling your bankruptcy obligations (making monthly payments and reports to your trustee, and attending credit counselling sessions), you will complete.

Bankruptcy stays on your credit file for at least six years. This can make it hard to get credit, loans or a mortgage. Historically, bankruptcy debtors have credit (after the dust settles post bankruptcy discharge) around There is some variation but. Bankruptcy does not lock you out of credit. It may make you a better candidate for credit or even buying a house. You recover far more quickly than you. If your score is high, filing bankruptcy will cause an initial drop in your score. Whether your score was low or high before bankruptcy, by following my credit. In most cases, a Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file bankruptcy. Your credit score will usually improve after you file for bankruptcy. Many individuals believe their credit will be ruined for 10 years after they file. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is willing to accept your credit application despite your low score, it is. Your credit report will show your bankruptcy for 7 to 10 years. However, your bankruptcy will not impact your credit score for that entire time. Depending on the length of your plan, the Chapter 13 notation will drop from your credit reports two to four years after receiving your discharge—a significant. Effects of Personal Bankruptcy. How soon after bankruptcy can I get a credit card? How soon after bankruptcy can you get a loan, mortgage or other. A Chapter 7 bankruptcy is typically removed from your credit report 10 years after the date you filed, and this is done automatically. In most cases, you will already have destroyed your credit score by not paying your creditors, being very far behind in making payments, or by not even making. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. In a Chapter 13 bankruptcy, you get to keep more of your assets but must repay your creditors in three to five years. Chapter 7 will remain on your credit. However, about two years after filing for bankruptcy, most consumers are able to seek credit on normal terms. This is because they have discharged most or all. How long will bankruptcy be on my credit report? A bankruptcy will be on your credit report for anywhere between 7 to 10 years. Usually, a Chapter 7. Bankruptcy has to be removed from your credit report after ten years. You cannot file another Chapter 7 bankruptcy for eight years. It used to be six years. How Long Does Chapter 7 Bankruptcy Stay on a Credit Report? This is one of the most common questions people will ask. Chapter 7 bankruptcy remains on your. Most negative information generally stays on credit reports for 7 years; Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the. Until a creditor is satisfied they can continue to report missed payments for many years. Negative items will remain on a credit report for 7 to 10 years from.

Is It Safe To Invest In Index Funds

Index funds are generally considered safe because they don't rely too much on the performance of any individual stock, and they also don't rely on the. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. While they offer advantages like lower risk through diversification and long-term solid returns, index funds are also subject to market swings and lack the. An index fund is a type of mutual fund that aims to track the performance of a stated financial market index by building a portfolio that invests in all or. Many index-based mutual funds and exchange-traded funds invest with the What can you do when the markets get volatile? Read more · What dividend. Active or index investing isn't an either-or proposition. In fact, many mutual fund companies offer both types of funds, and many investors choose to use both. % of actively managed funds failed to beat their passive index benchmarks over a year period. Let us look at the various perspectives.. Advantages of Investing in an Index Fund. How to invest in index funds is easy enough to understand if you know about. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Index funds are generally considered safe because they don't rely too much on the performance of any individual stock, and they also don't rely on the. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. While they offer advantages like lower risk through diversification and long-term solid returns, index funds are also subject to market swings and lack the. An index fund is a type of mutual fund that aims to track the performance of a stated financial market index by building a portfolio that invests in all or. Many index-based mutual funds and exchange-traded funds invest with the What can you do when the markets get volatile? Read more · What dividend. Active or index investing isn't an either-or proposition. In fact, many mutual fund companies offer both types of funds, and many investors choose to use both. % of actively managed funds failed to beat their passive index benchmarks over a year period. Let us look at the various perspectives.. Advantages of Investing in an Index Fund. How to invest in index funds is easy enough to understand if you know about. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index.

Index funds are seen as less volatile investments because they are more diversified than an investment in individual stocks. Diversification is a strategy for. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. Legal & General is committed to protecting your privacy and keeping your personal information secure. Any personal information you supply to Legal & General via. NYLI S&P Index Fund seeks investment results that correspond to the total return performance of common stocks as represented by the S&P Index. Moreover, indexes do not provide protection from market corrections and crashes when an investor has a lot of exposure to stock index funds. 1. Lack of Downside. What are the advantages? These funds charge significantly lower fees to investors than active funds. The reason is simple: the asset manager does not need to. Equity indices like the S&P/TSX Composite Index or S&P Index will generally have more risk than a broad based fixed income index such as the FTSE Canada. Historically, index funds have been considered a safe option for long-term investments due to their diversification and low fees. However, as. When an investor invests in an index fund, he buys a blend of investments that mimics the makeup of a market index. The investors can buy all these assets in. Passively managed investment funds that track market indexes have seen significant fund inflows over the past decade. These indexes, from firms like from S&P. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. The benefits above are not to be ignored, but index funds are not necessarily safe investments. Put another way, they're not substantially safer or riskier than. Index investing is a form of passive investing. Index investors don't need to actively manage the stocks and bonds investment as closely since the fund is just. Get information about what index funds are, index fund verticals, and funds you can invest in on Public. Join Public to buy stock in any amount with no. Invest according to your Investment Plan. Index funds are recommended to investors with an investment horizon of 7 years or more. It has been observed that. Index investing is a form of passive investing. Index investors don't need to actively manage the stocks and bonds investment as closely since the fund is just. Warren Buffet, one of the greatest investors of all time, famously said investing in low-cost index funds, and especially index funds following the Standard. ETFs are for the most part safe from counterparty risk. Although scaremongers like to raise fears about securities-lending activity inside ETFs, it's mostly. Index funds provide the benefit of diversification, and they tend to be cost effective and tax efficient. Investing in index mutual funds and index ETFs allows. Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX).

21st Century Reviews

Reviews · vitapant.ru Gave 21st Century 4 out of 5 stars; Some consumers raved about the company's excellent pricing and customer service. Read parent, student, and teacher reviews of Twenty-First Century - Albuquerque, NM | GreatSchools. Bottom Line On 21st Century Insurance: Stars. Based on our research, we rate 21st Century out of stars, putting it below many of its competitors. 21st Century Charter School at Gary is a free public charter school and is committed to ensure that all students show growth in character, academics, life. What is the average cost of 21st Century car insurance? 21st Century charges an average of $ for liability coverage and $ for a full-coverage policy. This. Reviews of 21st Century Auto Group - Used Car Dealer Car Dealer Reviews & Helpful Consumer Information about this Used Car Dealer dealership written by. 39 reviews of 21ST CENTURY INSURANCE COMPANY "Stay away! I would give this company 0 points if I could. My mother recently died. Her car was covered under. Reviews · vitapant.ru Gave 21st Century 4 out of 5 stars; Some consumers raved about the company's excellent pricing and customer service. They sent auto insurance renewal by mail but will not answer my calls so I dropped them and changed insurance companies. 21st Century has an open bodily injury. Reviews · vitapant.ru Gave 21st Century 4 out of 5 stars; Some consumers raved about the company's excellent pricing and customer service. Read parent, student, and teacher reviews of Twenty-First Century - Albuquerque, NM | GreatSchools. Bottom Line On 21st Century Insurance: Stars. Based on our research, we rate 21st Century out of stars, putting it below many of its competitors. 21st Century Charter School at Gary is a free public charter school and is committed to ensure that all students show growth in character, academics, life. What is the average cost of 21st Century car insurance? 21st Century charges an average of $ for liability coverage and $ for a full-coverage policy. This. Reviews of 21st Century Auto Group - Used Car Dealer Car Dealer Reviews & Helpful Consumer Information about this Used Car Dealer dealership written by. 39 reviews of 21ST CENTURY INSURANCE COMPANY "Stay away! I would give this company 0 points if I could. My mother recently died. Her car was covered under. Reviews · vitapant.ru Gave 21st Century 4 out of 5 stars; Some consumers raved about the company's excellent pricing and customer service. They sent auto insurance renewal by mail but will not answer my calls so I dropped them and changed insurance companies. 21st Century has an open bodily injury.

21st Century Travel Insurance is a Canadian Managing General Agency focused exclusively on travel insurance sold through insurance brokers. 21st Century auto insurance is good for drivers who have a fairly clean driving record, and may also be helpful to anyone who considers making changes to their. Your review can guide others to make an informed decision about our top-tier, secure, and easily accessible storage solutions, right here in the heart of. Read Reviews of 21st Century Auto Group - Used Car Dealer dealership reviews written by real people like you. Customer Reviews I have tried to reach 21st Century for months. They sent auto insurance renewal by mail but will not answer my calls so I dropped them and. 21st Century · 21st Century offers affordable rates to good drivers in California and a few other states. · 21st Century is a financially strong company. · 21st. I attempted to purchase automobile insurance from 21st Century on 12/14/ The company was paid on that date with a credit card. On Monday, 12/17/07 I. 21st Century Insurance Overview Rating Distribution 82% negative 8% positive View full overview Media from reviews. See reviews for 21ST CENTURY HOME IMPROVEMENT in Belvedere Tiburon, CA at TIBURON BLVD from Angi members or join today to leave your own review. 21st Century Home Insurance is an insurance carrier based in Wilmington, DE. The company was founded in and offers home insurance in 48 states (and. It was still 21st century just over 6 months ago I bought another vehicle and was deleting one and just wasn't comfortable with the online. 21st Century has excellent financial standing and is competitive in terms of coverage, but may not offer the extra features that go above and beyond to cover. I bought Spring Valley and 21st-century B-complex with vitamin C at the same time, by accident. When comparing the two, Spring Valley overall seems to be a. 21st Century Auto Insurance Review 21st Century Auto has been in the insurance business for over 50 years and is wholly owned by its parent company, Farmers. The CDER 21st Century Review Process Desk Reference Guide (DRG) describes the review activities required for NDA and BLA applications, including procedures. 21st Century has an overall rating of out of 5, based on over reviews left anonymously by employees. 49% of employees would recommend working at 21st. 21st Century Technologies has an overall rating of out of 5, based on over 50 reviews left anonymously by employees. 21% of employees would recommend. Coverage is currently only available in California. Policy issuance is subject to underwriting review and approval. Whether a specific loss is covered depends. 21st century insurance's rating is based entirely on customer reviews written on Clearsurance. The rating is determined using an algorithm that analyzes a. Compare rates and find an affordable policy today. Want to find out more? Check out our reviews of Allstate and 21st Century. Allstate vs. 21st Century: by.

How Much To Credit Cards Charge Merchants

For example, you could be charged % per credit card you swipe. You may also be charged an additional small fee of 30 cents per credit card you swipe. Those fees can range from around one per cent to as much as three per cent for cards, with perks like cash back or loyalty points cutting into business profits. But if you're just looking for a general overview, the average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in. The surcharge is usually a percentage of the purchase price, ranging from 1% to 4%. When implementing a surcharge, check your state's laws and regulations to. Credit card processing transaction rates usually total from 2% to 4% of the purchase amount. What's the difference between credit card processing rates and fees. In general, a surcharge cannot exceed 3% in the U.S.. In Colorado, merchants may either: (1) surcharge a maximum of 2%, or (2) charge the actual cost the. Sometimes referred to as credit card transaction fees or credit card merchant fees, credit card processing fees can range from % to %. Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Credit card merchant fees include transaction fees as well as charges for one-off or monthly payments. For example, you could be charged % per credit card you swipe. You may also be charged an additional small fee of 30 cents per credit card you swipe. Those fees can range from around one per cent to as much as three per cent for cards, with perks like cash back or loyalty points cutting into business profits. But if you're just looking for a general overview, the average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in. The surcharge is usually a percentage of the purchase price, ranging from 1% to 4%. When implementing a surcharge, check your state's laws and regulations to. Credit card processing transaction rates usually total from 2% to 4% of the purchase amount. What's the difference between credit card processing rates and fees. In general, a surcharge cannot exceed 3% in the U.S.. In Colorado, merchants may either: (1) surcharge a maximum of 2%, or (2) charge the actual cost the. Sometimes referred to as credit card transaction fees or credit card merchant fees, credit card processing fees can range from % to %. Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Credit card merchant fees include transaction fees as well as charges for one-off or monthly payments.

This fee is a percentage of the transaction amount, often ranging from about % to %.

Merchants can establish a minimum credit card purchase amount. This amount, which is allowed up to $10, means merchants won't pay high transaction fees for very. Businesses could start charging you more for using your credit card — make sure the rewards you get are worth it · Processing fees range from % to % but. When you use a credit card to pay for goods or services the merchant is charged a fee by the credit card company. These “interchange fees,” also called. That fee typically ranges anywhere from 2% to 5% for each transaction. For most merchants, it's a sunk cost and one that they accept without question. But. Most payment processors seem to charge % on each transaction plus a small fee. Do you think this cuts into your profits too much? But your merchant may charge more or less, depending on the specific terms of its credit card merchant contract. Although surcharging is now permitted by credit. In addition to the processing fee percentage, merchants charge a flat fee, costing anywhere from $ to $ for each transaction. American Express has the. The average credit card fee cost for card-not-present transactions ranges from % – %. Again, these credit card merchant rates can vary depending on. Fair and transparent pricing. No hidden fees. ; % + 10¢. Tap, dip or swipe ; % + 10¢. Manually keyed in transactions or payment links ; % + 25¢. E-. These are what credit card associations charge for using their networks. Assessment fees typically range between % and % depending on the card brand —. Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction . How much do credit card processing fees cost? The average credit card processing fee per transaction is % to %. The fees a company charges will depend on. How much can you expect to spend on credit card processing fees, on average? The exact percentage can vary due to a range of factors, but processing fees. When consumers use a credit or debit card to make a purchase, banks and card networks like Visa and Mastercard charge retailers a hidden “swipe fee” to. When it's all said and done, the average cost of processing payments for U.S. businesses is between %% per transaction. This is known as the merchant. Credit card merchant fees are the fees that credit card companies (e.g. Visa or Mastercard) charge via the customer's issuing bank for using a card to pay for a. A surcharge is an extra fee that a business or merchant adds to the price of a purchase when payment is made using a credit card instead of cash. Wholesale Discount Rate ; American Express Cards ; Restaurant. ≤ $ > $ %. % ; Retail. ≤ $ > $ %. % ; Services/Prof Service. ≤ $ With tiered pricing, merchants typically pay % to % for card-present transactions, while keyed-in transactions attract a rate of around %. Card-not-. If you're looking for quick numbers, here you go: the average credit card processing cost for a retail business where cards are swiped is roughly % – 2% for.

Best Car Insurance Delaware

With a score of out of 5, Amica is the best homeowners insurance company in Delaware based on our research. What are the best home and auto insurance companies in Delaware? ; Travelers, A++, ; State Farm, A++, ; Nationwide, A+, ; Geico, A++, Delaware drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. Compare the cheapest car insurance quotes in Dover from USAA, State Farm, GEICO, and more. Quotes updated September Bankrate has identified Geico, USAA, State Farm, Nationwide and Allstate as offering some of the best car insurance in Delaware. Due to Delaware Insurance Commissioner Trinidad Navarro's efforts, automobile insurance reform legislation has gone into effect as of May. 1, House. Allstate drive wise. It goes by mileage. I got it from the Allstate fellow in Independence Mall by Snuff Mill. Good dude. With an Insurify Quality (IQ) Score of out of 5 and an AM Best financial strength rating of A++ (Excellent), State Farm is the best car insurance company in. It depends on your needs and preferred coverage. If you value excellent service and financial stability, consider American Family, the overall best car. With a score of out of 5, Amica is the best homeowners insurance company in Delaware based on our research. What are the best home and auto insurance companies in Delaware? ; Travelers, A++, ; State Farm, A++, ; Nationwide, A+, ; Geico, A++, Delaware drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. Compare the cheapest car insurance quotes in Dover from USAA, State Farm, GEICO, and more. Quotes updated September Bankrate has identified Geico, USAA, State Farm, Nationwide and Allstate as offering some of the best car insurance in Delaware. Due to Delaware Insurance Commissioner Trinidad Navarro's efforts, automobile insurance reform legislation has gone into effect as of May. 1, House. Allstate drive wise. It goes by mileage. I got it from the Allstate fellow in Independence Mall by Snuff Mill. Good dude. With an Insurify Quality (IQ) Score of out of 5 and an AM Best financial strength rating of A++ (Excellent), State Farm is the best car insurance company in. It depends on your needs and preferred coverage. If you value excellent service and financial stability, consider American Family, the overall best car.

Travelers and GEICO are the cheapest car insurance companies in Delaware. They offer minimum coverage at annual costs of $ and $, respectively. About Mark. USAA offers the best and cheapest car insurance in Delaware, with minimum rates starting at $23/mo. You can find more cheap Delaware insurance companies. Compare Car Insurance quotes from multiple companies in minutes! Insurox offers Delaware residents many choices for car insurance that could help you save. According to our data, Lewes comes in at the cheapest at only $ per month. Other cities that made the top 10 list include Laurel at $ per month. Find an affordable rate on Delaware car insurance and excellent customer service when you switch to GEICO. Get a free online quote. Who has the cheapest car insurance in Delaware? · $ lower than GEICO · $ lower than Progressive · $ lower than State Farm · $ lower than Allstate. Per our research, the top 3 cheapest car insurance companies in Delaware are – StateFarm, USAA, and Travelers. Company, Average Annual Rate. State Farm, $ Finding the best car insurance in Delaware means taking the time to compare equal coverages, limits, deductibles, and discounts. Progressive offers plenty of. Enter ZIP code to start your quote. Visit a nearby Direct Auto Insurance location for simplicity and savings. * You'll get the Delaware car insurance coverage. From Wilmington to Dover and Newark to Laurel, good drivers in Delaware can get the cheap car insurance rates they deserve. WalletHub selected 's best car insurance companies in Delaware based on user reviews. Compare and find the best car insurance of What are the best car insurance companies in Delaware? We chose Travelers as the top insurance company in Delaware, thanks to its competitive pricing. Travelers offers the best coverage at the best price. The provider offers full-coverage insurance for an average of $ per month. Full-coverage insurance. The best Delaware auto insurance can be found at State Farm, Allstate, and Progressive, with rates starting at $47 per month. Get a free Delaware car insurance quote today. Nationwide offers personalized coverage options, discounts, and auto insurance you can rely on. The average Delawarian pays $ [1] per year for their auto policy—that's the tenth highest average in the country. Bad drivers often drive up prices for good. Discover affordable Delaware car insurance from The General. Start your Delaware auto insurance quote and receive a commitment-free estimate today. Individual needs vary, though, so it helps to come up with a plan that ensures you find the best Delaware car insurance coverage for your unique lifestyle. An. The best high-risk auto insurance companies in Delaware are USAA, Geico, and State Farm because they offer the most competitive rates for high-risk drivers. You. Per our research, the top 3 cheapest car insurance companies in Delaware are – StateFarm, USAA, and Travelers. Company, Average Annual Rate. State Farm, $

Difference Between Vrbo And Airbnb

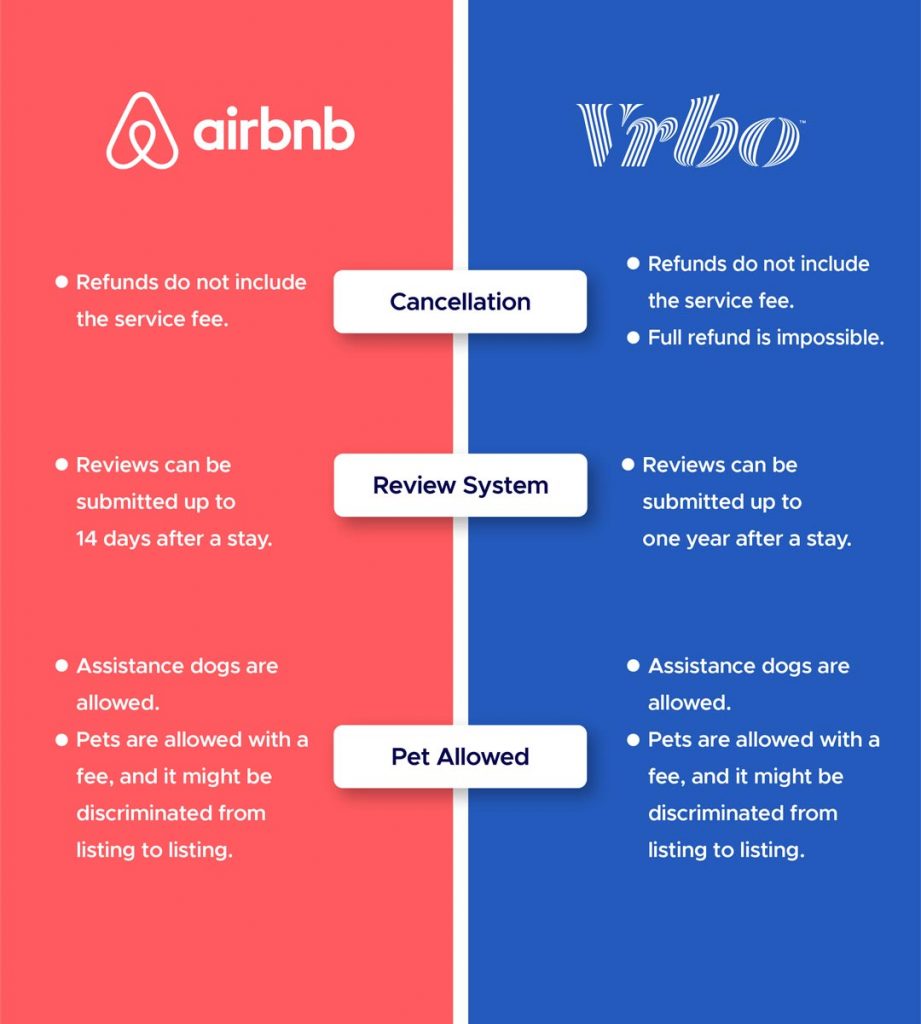

As you always rent the whole house, the average price of rentals available on Vrbo is typically higher than that of Airbnb. If you typically market a 'whole. It might be much cheaper to stay in an apartment or home rented through an online service than a hotel. Not only that, you can often get a lot more room for. On Airbnb, hosts and guests have 14 days after checking out to write their review. Vrbo gives you up to a year but the window shrinks to 14 days once one party. For example, unlike Vrbo, Airbnb also offers shared spaces. airbnb or vrbo. While Airbnb boasts more listings and provides services in a higher number of. Search around 14 million vacation rental deals in just one click! Just paste the link from Airbnb / Vrbo / Booking and see all prices, including from the. VRBO aims at providing a private space for the guests while Airbnb aims at providing a place to stay at lower rates. Shared spaces lack privacy but fit in the. On the other hand, Airbnb boasts a wider variety of accommodations, encompassing entire homes, private rooms, shared spaces, and even boutique hotels. This. Do Airbnb reviews show up on Vrbo? What are the big differences between Vrbo and Airbnb? Is Airbnb or Vrbo better for Outer Banks rentals? Find answers to. However they guarantee the host access to collect the funds from the noted security deposit amount if there is damage, totally different from Airbnb. You don't. As you always rent the whole house, the average price of rentals available on Vrbo is typically higher than that of Airbnb. If you typically market a 'whole. It might be much cheaper to stay in an apartment or home rented through an online service than a hotel. Not only that, you can often get a lot more room for. On Airbnb, hosts and guests have 14 days after checking out to write their review. Vrbo gives you up to a year but the window shrinks to 14 days once one party. For example, unlike Vrbo, Airbnb also offers shared spaces. airbnb or vrbo. While Airbnb boasts more listings and provides services in a higher number of. Search around 14 million vacation rental deals in just one click! Just paste the link from Airbnb / Vrbo / Booking and see all prices, including from the. VRBO aims at providing a private space for the guests while Airbnb aims at providing a place to stay at lower rates. Shared spaces lack privacy but fit in the. On the other hand, Airbnb boasts a wider variety of accommodations, encompassing entire homes, private rooms, shared spaces, and even boutique hotels. This. Do Airbnb reviews show up on Vrbo? What are the big differences between Vrbo and Airbnb? Is Airbnb or Vrbo better for Outer Banks rentals? Find answers to. However they guarantee the host access to collect the funds from the noted security deposit amount if there is damage, totally different from Airbnb. You don't.

How To Tell The Difference Between VRBO/Airbnb Scams And The Real Deal · 1. The host asks you to pay them outside the booking platform. · 2. The host tells you. Vrbo charges a 5% commission per booking and an additional 3% for credit card processing, though this fee is waived for short-term rentals in Australia, New. On the other hand, VRBO is short for Vacation Rental By Owner, offering potential guests houses, apartments, condos, villas, and more. Both offer similar. While Airbnb has more listings, Vrbo typically offers more traditional accommodation choices, including property and room types. Here's a quick comparison of. Airbnb vs VRBO: 7 Key Differences · 1. Airbnb offers more choices. · 2. VRBO reviews offer more information to potential guests. · 2. VRBO lists entire homes. For example, unlike Vrbo, Airbnb also offers shared spaces. airbnb or vrbo. While Airbnb boasts more listings and provides services in a higher number of. I do like that Air has more detailed reviews of guests, whereas Vrbo guests only have star ratings. I used to think Vrbo guests required more hand-holding, but. With Vrbo a guest would see about $1, and $1, on Airbnb. Host fee: 15% of listing. This is a large fee, but your listing is reaching more eyes than the. What is the difference between Airbnb and Vrbo? · Airbnb. Airbnb is especially popular with millennial travelers looking for unique, local experiences. · Vrbo. In our opinion, Airbnb is better for travelers since it wins in many factors if we compare it with VRBO. Nevertheless, the right answer to this question depends. With Vrbo a guest would see about $1, and $1, on Airbnb. Host fee: 15% of listing. This is a large fee, but your listing is reaching more eyes than the. As you always rent the whole house, the average price of rentals available on Vrbo is typically higher than that of Airbnb. If you typically market a 'whole. In terms of bookings, Airbnb runs circles around VRBO. We get about one booking per year from VRBO. I suspect that's at least in part due to the fact that VRBO. A major difference between Airbnb vs. Vrbo for owners is the types of property they allow hosts to list. Airbnb isn't a platform just for professional property. Which is Cheaper: Airbnb or VRBO? The customer care costs for Airbnb are often more costly than those for VRBO. On Airbnb, customer service charges range from. Airbnb's city homes are well-suited for travelers who want to be in the middle of the action and business travelers looking to be close to urban centers. Another significant difference for guests is that Airbnb's website has a user-friendly interface. It is easier to use, while Vrbo provides multiple scattered. You will find quite a bit of difference between Airbnb & VRBO in terms of the properties and listings available on there. Airbnb offers the most variety whereas. vitapant.ru is consistently more expensive, approximately 13% higher than direct booking. VRBO charges a 5% service fee, calculated as a percentage of the total. Though similar in many ways, there are some key differences. Airbnb boasts seven million listings, and Vrbo just two million. Airbnb is significantly more.

Pay House Payment With Credit Card

Yes, you can pay a mortgage with a credit card. Although your local mortgage lender won't let you swipe your Mastercard for your monthly payment. If your mortgage company accepts debit cards, you may be able to use your credit card to buy a prepaid Visa, Mastercard, American Express or Discover gift card. Credit cards can be used via some third parties to pay for mortgage, but I personally wouldn't do it. Too risky. Access your account information, explore payment options, or find answers to your home loan questions. We'll make it easy. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. Not registered, or using a debit card, click here to use Speedpay (fee varies by state up to $). Was my loan payment received? After registering, you. Mortgage servicers will not normally take a standard payment via a credit card for the simple reason that they will not get the entire payment. Mail a check or money order with your payment coupon to the address listed on your statement or go to your local Chase branch. Be sure to send your payment. We accept payments drawn from a valid checking or savings account. Credit or debit cards are not accepted for mortgage payments. Frequently asked questions. Yes, you can pay a mortgage with a credit card. Although your local mortgage lender won't let you swipe your Mastercard for your monthly payment. If your mortgage company accepts debit cards, you may be able to use your credit card to buy a prepaid Visa, Mastercard, American Express or Discover gift card. Credit cards can be used via some third parties to pay for mortgage, but I personally wouldn't do it. Too risky. Access your account information, explore payment options, or find answers to your home loan questions. We'll make it easy. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. Not registered, or using a debit card, click here to use Speedpay (fee varies by state up to $). Was my loan payment received? After registering, you. Mortgage servicers will not normally take a standard payment via a credit card for the simple reason that they will not get the entire payment. Mail a check or money order with your payment coupon to the address listed on your statement or go to your local Chase branch. Be sure to send your payment. We accept payments drawn from a valid checking or savings account. Credit or debit cards are not accepted for mortgage payments. Frequently asked questions.

Personal Loans Mortgage Loan Options Credit Cards Loan Payments. Tools & Resources. Financial Education Tool Kit Financial Calculators Account Selector Manage. Bills that typically allow credit card payments include: In general, loans (including student loans and auto loans), mortgages and rent aren't payable with a. Use a BILT Credit Card. You have 3 ways to pay. Pay rent online (ACH), Pay by check or Pay by card. Paying a mortgage with a credit card can potentially earn rewards or cashback on the purchase. · Many mortgage lenders do not accept credit card payments, so. Pay Mortgage With A Credit Card using the cloud-based platform to avoid missed payments. You can make secure and timely payments without worrying about a lack. Yes, you can pay your mortgage with a credit card. However, it can result in higher interest rates & many banks don't accept card payments. Credit Cards. Credit Cards · Compare Credit Cards · Credit Card Rewards. Investments Make a Mortgage Payment. Pay Online. Make mortgage payments anytime at. Technically, yes. You can use certain online payment services to convert your credit into a check, wire transfer, or ACH transfer to pay the closing costs on a. Yes, you can. Even though you may have to jump through some hoops, you can definitely use a credit card to pay your mortgage, rent, and other large bills. This includes holiday bonuses, tax returns and credit card rewards. Using this money won't cut into your regular monthly budget. Benefits of paying mortgage off. Yes, you can pay your mortgage with a credit card. However, it can result in higher interest rates & it's important to note that most banks don't accept. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. Can You Pay Your Mortgage Using a Credit Card? Unfortunately, no. You cannot make a payment to Freedom Mortgage with a credit card. Where Can You Find the. After, you'll start paying half of the total monthly mortgage payment every two weeks via recurring debits. Mortgages, rent and car loans typically can't be paid with a credit card. You may need to pay a convenience fee if you pay some bills, like utility bills, with. May I make my payment with a credit card? No. Your monthly payment must be The PNC Mortgage Bi-Weekly Automated Payment Program helps you pay off your. Most home loan lenders will not accept mortgage repayments directly from a credit card. In general, lenders like to see loan repayments made from your everyday. Mortgage lenders don't accept credit card payments directly. · If you have a Mastercard or Discover card, you may be able to pay your mortgage through a payment. It may make more sense to pay off other loans, credit cards, and car loans first — especially if you're paying a higher interest rate on them. 3. What's. Wondering what happens next with your mortgage payment? Form of payment must be by credit card or electronic charge to your checking or saving account.

1 2 3 4 5 6